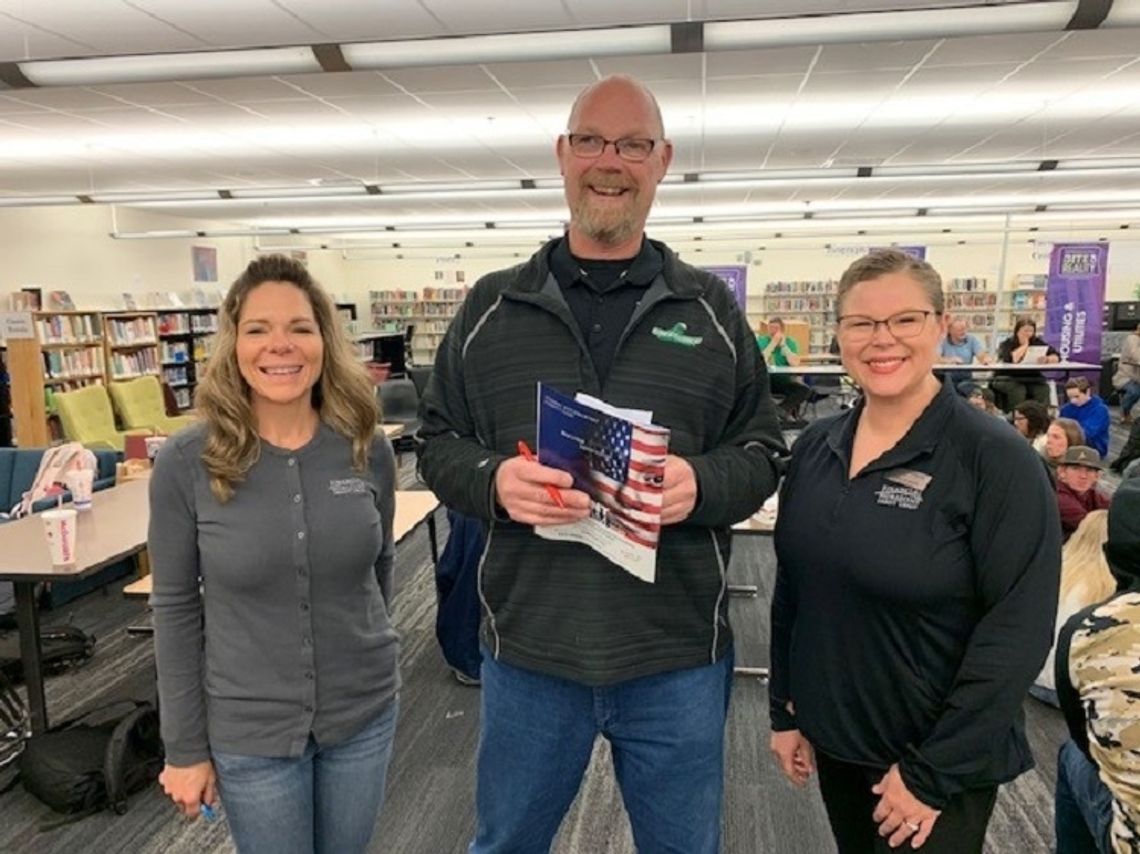

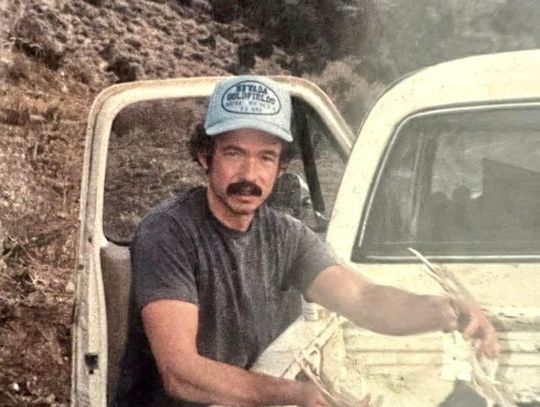

Keith Lund, an educator and athletics coach at Churchill County High School, has received a $10,000 grant to help with his instruction of a Personal Finance class at the high school. Last fall, the School Board of Trustees mandated that beginning with the class of 2023, each student must take a semester of personal finance in order to graduate.

At that time, Lund approached Superintendent Summer Stephens to get her support to apply for the grant through the Next Gen Personal Finance organization. Next Gen is an organization dedicated to revolutionizing the teaching of personal finance in all schools in order to improve the financial lives of the next generation of Americans.

According to the Next Gen website, in 2014, Tim and Jessica Endlich founded Next Gen Personal Finance as a non-profit organization to partner with teachers by sharing timely and relevant curricular resources, providing effective professional development, and advocating to increase access to financial education. Given the organization's commitment to reach ALL students, NGPF provides its curriculum and PD at no cost to schools.

Lund said that Stephens was completely supportive of his application. “She was behind me 100%.”

In order to receive the grant, Lund made a presentation to the board about requiring Personal Finance for all high school graduates. He said, “I had the backing of many people in the community and a few were at the board meeting to express support.”

Because the school board had increased graduation credits by one-half of a credit, they were able to fit in the personal finance class as a required class for graduation.

“If it wasn’t for the increase in credits, I don’t think it would have happened,” Lund said.

Next year the requirement will kick in and all Churchill County High School graduates will have to take the Personal Finance class.

Lund received the $10,000 grant to be used for future projects and strategies to make the class beneficial for all the students in attendance.

On their website, Next Gen recognized Lund for his work on behalf of the students in Churchill County. “Keith Lund is an educator and Changemaker from Churchill County High School in Fallon, Nevada. After years of Keith's proposals to make personal finance a graduation requirement, Churchill County adopted the graduation requirement during the 2019 school year, making the high school the 35th in the nation to earn NGPF's Gold Standard Challenge grant in the process!”

Next Gen often references a paper and brief, authored by Jeremy Burke, J. Michael Collins, and Carly Urban, which estimates the effect of required high school financial education on the financial well-being of young adults. The paper defines financial well-being as including a person’s sense of financial management, as well as their confidence in achieving their own unique financial goals. The study showed that financial education improves financial well-being.

Summer Stephens, superintendent for the district said she is pleased about this direction for students. “The district is pleased to be able to put the graduation requirement into place for the class of 2023 and beyond. We know that a key to being life ready is to be fully prepared with financial literacy.”

Sign up to receive updates and the Friday File email notices.

Support local, independent news – contribute to The Fallon Post, your non-profit (501c3) online news source for all things Fallon.

The Fallon Post -- 1951 W. Williams #385, Fallon, Nevada 89406

Comment

Comments