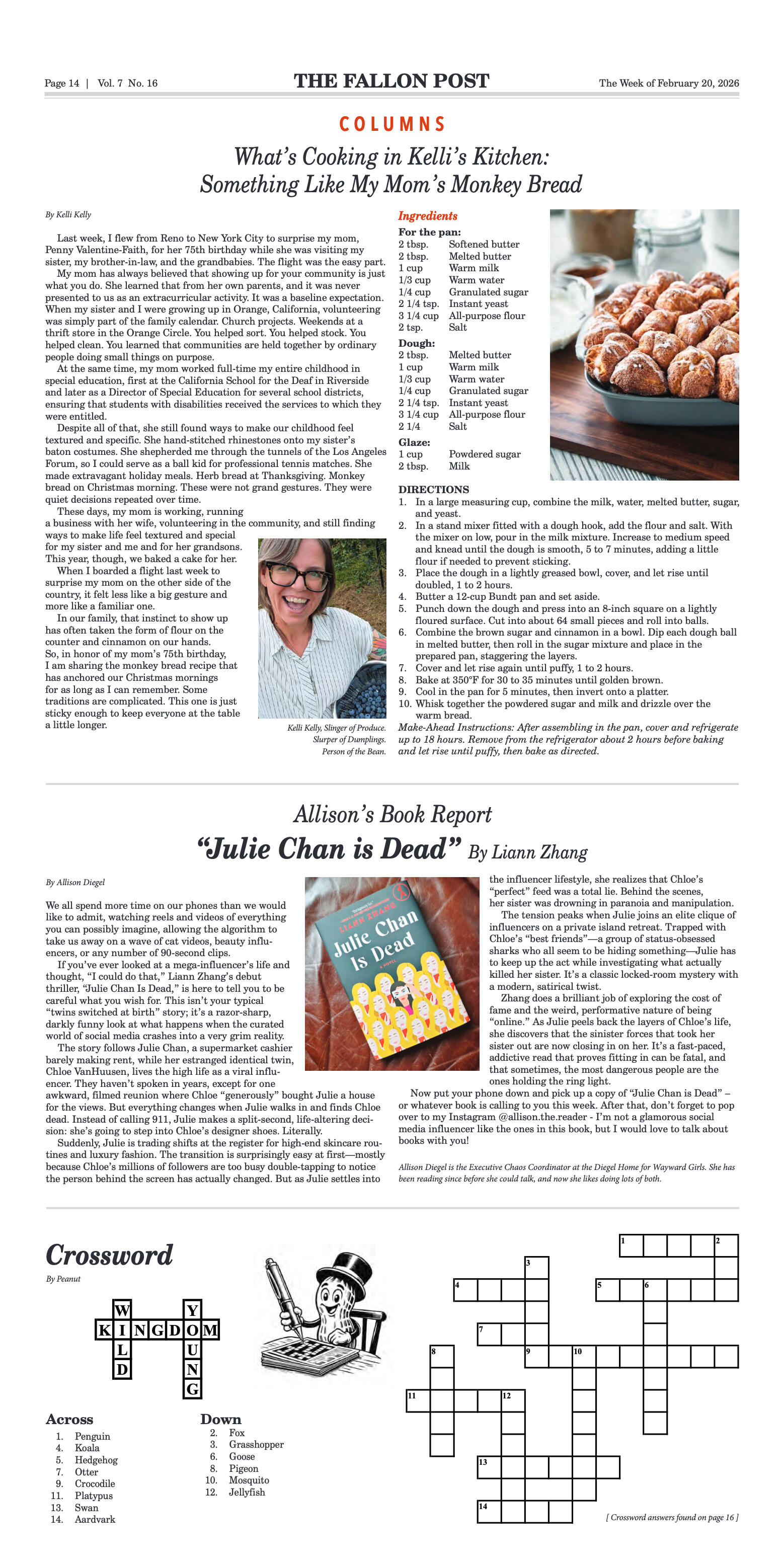

If you’re a dad, you may well be pleased to unwrap some tools as Father’s Day gifts. Of course, it might be a stereotype that all men are handy at repairs; women certainly can be every bit as good when it comes to building and fixing things. In fact, the construction process is valuable for anyone to learn – and the same skills that go in to creating and mending physical objects also can be applied to financial projects – such as working toward a comfortable retirement. Here are a few of those skills: Diagnosing the challenge –A good craftsperson knows that the first step toward accomplishing any outcome is to assess the challenge. So, for example, if you want to build some bookshelves right into the wall, you’ll need to locate the wall studs, determine if you have adequate space for the shelving you want and allow room for future expansion. Similarly, if you want to retire at a certain age, you need to consider the key variables: your current and future income (How much can you count on from your retirement plans?), where you'll live (Will you downsize or relocate? Will you rent or own a house or condominium?) And what you'll do as a retiree (Will you travel extensively or stick close to home? Will you do some type of work for pay or pursue your hobbies and volunteer?). Assembling the right tools and materials –To put together your bookshelf, you will need the right tools – saw, hammer, drill, sander and so on – and the right building materials – plywood, nails, screws, glue, brackets, moldings and so on. And to work toward a comfortable retirement, you'll also need the right tool – in the form of a long-term financial strategy, based on your specific retirement goals, risk tolerance and time horizon – along with the appropriate materials – the mix of investments you use to carry out that strategy. These investments include those you’ve placed in your IRA, your 401(k) or other employer-sponsored retirement plan, and those held outside your formal retirement accounts. Ideally, you want a diversified mix of investments capable of providing growth potential over time, within the context of your individual risk tolerance. Review your work –Once you’ve finished your bookshelf, you occasionally may need to make some minor adjustments or repairs in response to slippage, cracks or other issues that can develop over time. As an investor, you also may need to tweak your financial strategy periodically and adjust your investment mix – not necessarily because something is broken, but to accommodate changes in your life, such as a new job, new family situation and new goals. Furthermore, over time, your risk tolerance may change, and this needs to be reflected in your array of investments.. Consequently, conducting an annual portfolio review with your financial professional should be a priority. Tools are a big deal on Father’s Day. But the construction-related tasks they represent, physically and symbolically, go beyond any one holiday and can be used by anyone interested in working toward a solid financial future. This article was written by Edward Jones for use by your local Edward Jones Financial Advisor. Never miss a meeting or community event – keep an eye on the community calendar at https://www.thefallonpost.org/events/ If you like what we’re doing, please support our effort to provide local, independent news and contribute to The Fallon Post, your online news source for all things Fallon.

Father's Day: Tools Are Great for Father's Day – and for Investors

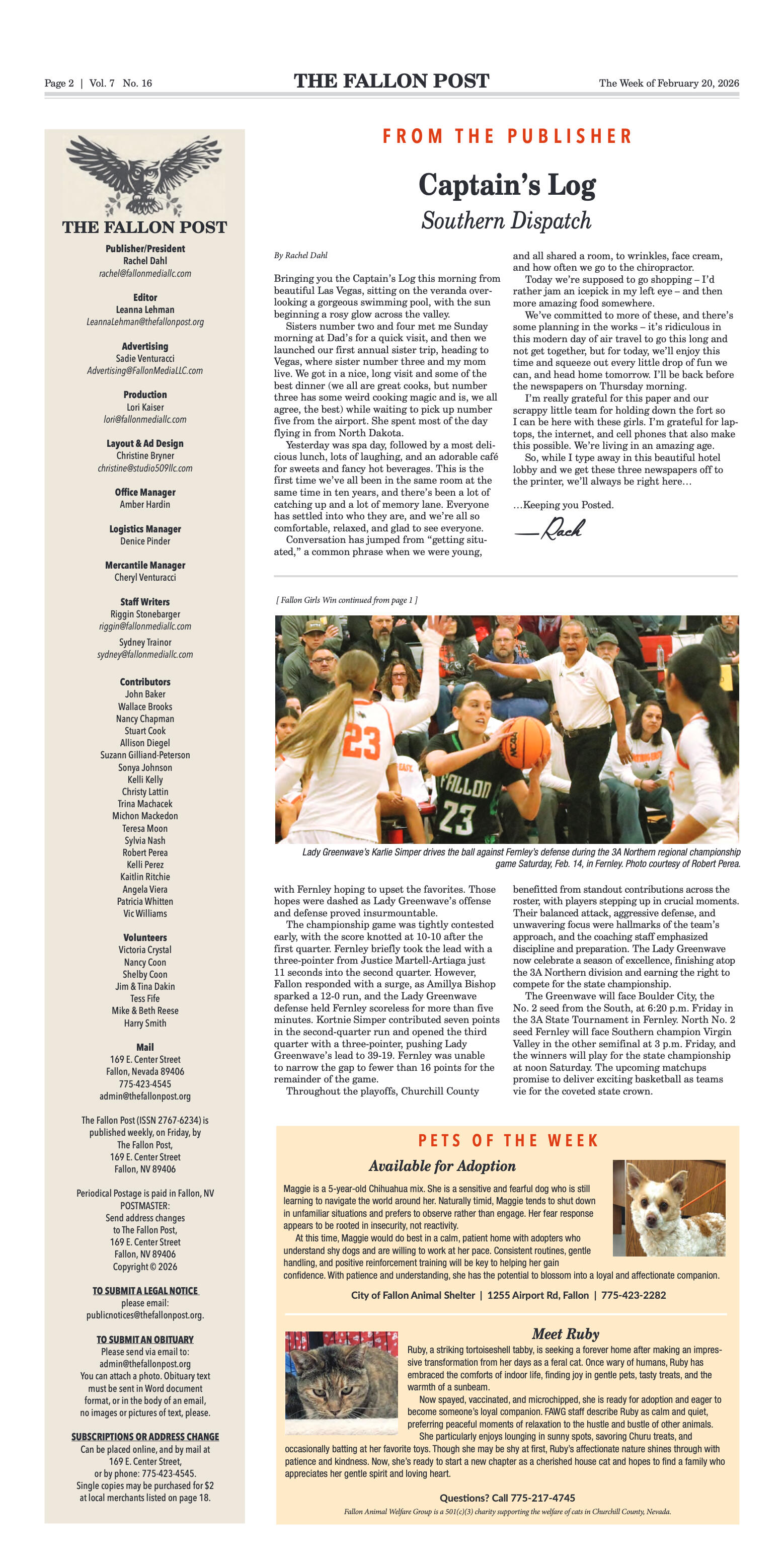

- 06/11/2019 04:02 AM (update 04/11/2023 01:44 AM)

Comment

Comments